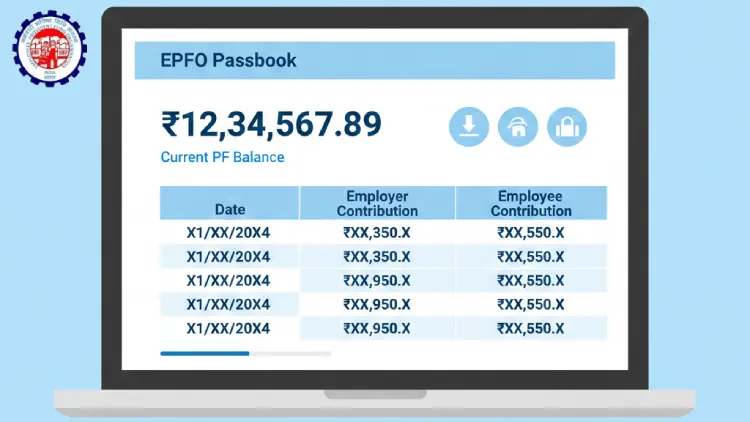

The EPFO passbook is a digital record that helps salaried employees track their provident fund contributions transparently and securely. It contains detailed monthly entries of employee and employer deposits, interest credits, and overall balance status. This passbook is especially useful for long-term financial planning, job changes, and retirement preparation. Since everything is available online, users no longer need to depend on physical statements or employer updates for contribution clarity.

The system is managed by EPFO, ensuring standardized records for millions of employees across India. With digital access, individuals can monitor inconsistencies early and maintain accurate employment-linked savings records. The passbook acts as financial proof during withdrawals, transfers, or claim settlements, making it an essential document for every registered employee.

Why the EPFO Passbook Is Important

The EPFO passbook gives complete visibility into provident fund savings accumulated over the employment lifecycle. It displays employee share, employer share, and pension contribution separately for better understanding. This clarity helps users confirm whether monthly deposits are happening correctly and on time. Any discrepancy can be reported early, avoiding future complications.

Another major benefit is its role in financial planning and loan applications. Banks and institutions often accept passbook statements as income-backed savings proof. Since interest is compounded yearly, tracking growth regularly ensures realistic retirement projections. Overall, the passbook strengthens trust between employees, employers, and the provident fund system.

How to Access EPFO Passbook Online

To view the EPFO passbook, users must have an active Universal Account Number linked with their employment records. Online access eliminates paperwork and reduces dependency on HR departments. The digital interface is designed for simplicity, allowing even first-time users to navigate without difficulty.

Login Process Steps

- Visit the official Epfo Portal from any secure browser

- Select member services and choose passbook option

- Enter UAN credentials through epfo uan login

- Verify using registered mobile OTP

- View or download passbook instantly

This process ensures data security while offering real-time access to contribution history.

Employee and Employer Login Differences

The passbook is primarily designed for employees, but employers also have dedicated access rights. Employees use EPFO employee login to view balances, download statements, and check interest credits. This access is limited to personal employment records only.

Employers, on the other hand, use the employer login to manage compliance tasks such as monthly challans, employee registrations, and contribution filings. While employers cannot see individual passbooks directly, their submissions directly affect what appears in employee records. Accurate employer filings ensure correct passbook entries without delays.

Unified Portal and Login Credentials

- The Epfo Unified Portal provides a single platform for all provident fund-related services

- Users can access passbook, claims, KYC, and profile management in one place

- Login is done using epfo login credentials linked with the UAN

- UAN Login ensures secure and verified access to personal PF information

- One UAN works across multiple employers under the same account

- Job changes do not create separate PF records due to unified structure

- Employees can view cumulative PF balance from all linked employers

- Manual PF transfer confusion is reduced through centralized data access

Common Issues While Checking Passbook

Sometimes, the EPFO passbook may not show recent contributions immediately. This usually happens due to employer filing delays or backend processing timelines. Interest updates are also posted annually, not monthly, which may cause confusion among users.

Another common issue is login errors during PF Login, often caused by inactive UANs or mismatched mobile numbers. Keeping personal details updated on the portal resolves most access-related problems quickly.

Key Features of the EPFO Passbook

- Displays monthly employee and employer contribution details

- Shows pension contribution separately

- Reflects interest credits annually

- Supports PDF download for records

- Useful for withdrawals, transfers, and claims

These features make the EPFO passbook a reliable financial tracking tool for long-term savings.

Managing Your PF Records Efficiently

Regularly reviewing the EPFO passbook helps employees stay informed and financially disciplined. It ensures accountability from employers and prevents future disputes during withdrawals or retirement claims. Digital availability also supports paperless record management, aligning with modern financial practices.

By understanding how to access and read passbook entries correctly, users can maximize the benefits of their provident fund savings confidently and securely.